federal unemployment tax refund for married filing jointly

Also if there are unpaid taxes or child support a refund could be offset or. These particular refunds are due to President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on up.

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

However this is not always the case.

. The IRS is issuing another 15 million refunds to workers who paid federal income taxes on their unemployment benefits they received. No married filing jointly is not correct. According to Massachusetts tax filing status definitions If married taxpayers have a Massachusetts residency tax year that begins and ends on different days they must file married.

Why sign in to the Community. Posted on by IRS to distribute refunds in two phases to those who overpaid taxes on unemployment benefits received in 2020. The law lets each person exclude up to 10200 of unemployment benefits from their federal taxable income for 2020.

Should not amend their returns unless they are newly eligible for. Federal Tax Refund E-File Status Question. Upvote if you think the irs did a bad job of handling the pandemic.

12550 for married taxpayers filing separate returns. Married Filing Jointly Tax Filing Status. If youre married and filing jointly you can exclude up to 20400.

If you file Form 1040-NR or file Form 1040 or 1040-SR separately from your spouse you generally dont report your spouses. Married filing jointly - Answered by a verified Tax Professional. To report your federal AGI and California tax.

The IRS has continued to clarify how the unemployment benefits exclusion from income for 2020 under the American Rescue Plan Act works in community property states now explaining the impact when the spouses file a joint return as well as the impact of returns when filing married filing separate. The IRS Has Good News These particular refunds are due to President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on. 25100 for married taxpayers filing jointly.

2021 Federal Tax Married Filing Jointly will sometimes glitch and take you a long time to try different solutions. A married couple can file jointly if the following conditions are met. We use cookies to give you the best possible experience on our website.

As an example if a couple gets married on December 30 under tax law they wouldve been. The standard deduction for the married filing jointly status is the largest available. Have you been able to access your account online.

While nearly 90 percent of all checks have been sent out so far it hasnt been nearly as smooth sailing for the refunds from the 2020 unemployment benefits which are from the waiving of federal tax on up to 10200 of jobless claimsor 20400 for married couples filing jointlythat were received by taxpayers in 2020. When Should I Expect My Tax Refund In 2022. In most cases it is more tax advantageous for a married couple to file a joint tax return than a married filing separate return.

Married Filing Jointly Tax Filing Status. 18800 for heads of household. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income.

Sign in to the Community or Sign in to TurboTax and start working on your taxes. Your wife would file as a part-year resident of Massachusetts. Therefore as of December 31 of the previous year the married status of the couple applies to the whole year.

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is. Spouses filing jointly with the IRS would each receive a 10200 unemployment tax exemption. Typically unemployment benefits are taxed like any other income.

The first 10200 of unemployment benefits per resident 20400 for those married and filing jointly are now nontaxable for returns with an adjusted gross income of less than 150000. Im waiting married filing joint I was unemployment she was employed made 1010000 called irs they said no flags on my account regarding any work being done. The married couple was married as of the last day of the tax year.

Federal tax refund. If your filing status is married filing jointly and both. If you and your spouse file a joint return and your joint modified AGI is less than 150000 you should exclude up to 10200 of your unemployment compensation and up to 10200 of your spouses unemployment compensation.

Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. 25100 for qualifying widow ers. If your filing status is married filing jointly and both spouses received unemployment benefits both can exclude up to 10200.

A return with a Married Filing Joint status means that both spouses are responsible for the income reported andor taxes owed. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. For example If you made 25000 in unemployment you will only pay taxes on 4600 of that.

As of tax year 2021 the return youd file in 2022 the standard deductions are as follows. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Where is my refund.

Bidens legislation changes the rules for 2020 to ensure individual taxpayers who received federal unemployment benefits wont have to pay tax on the first 10200 they received while couples filing jointly will be exempt from paying taxes on 20400 of benefits. They will forgive whatever federal taxes you paid up to 20400 for joint filers if you were both unemployed if only one spouse is unemployed then up to 10200. Furthermore you can find the Troubleshooting Login Issues section which can answer your.

For example If you made 25000 in unemployment you will only pay taxes on 4600 of that. LoginAsk is here to help you access 2021 Federal Tax Married Filing Jointly quickly and handle each specific case you encounter. The dates of residence would be 8142021 to 12312021.

That means married couples can exclude up.

Kolye Normallestirme Kaldir Federal Refund Taxable Living Outloud Com

Confused About Unemployment Tax Refund Question In Comments R Irs

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

When Will Irs Send Unemployment Tax Refunds King5 Com

Unemployment Tax Refund Update What Is Irs Treas 310 King5 Com

Irs Unemployment Refunds Moneyunder30

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Futa Tax Overview How It Works How To Calculate

Is Unemployment Compensation Going To Be Tax Free For 2021

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

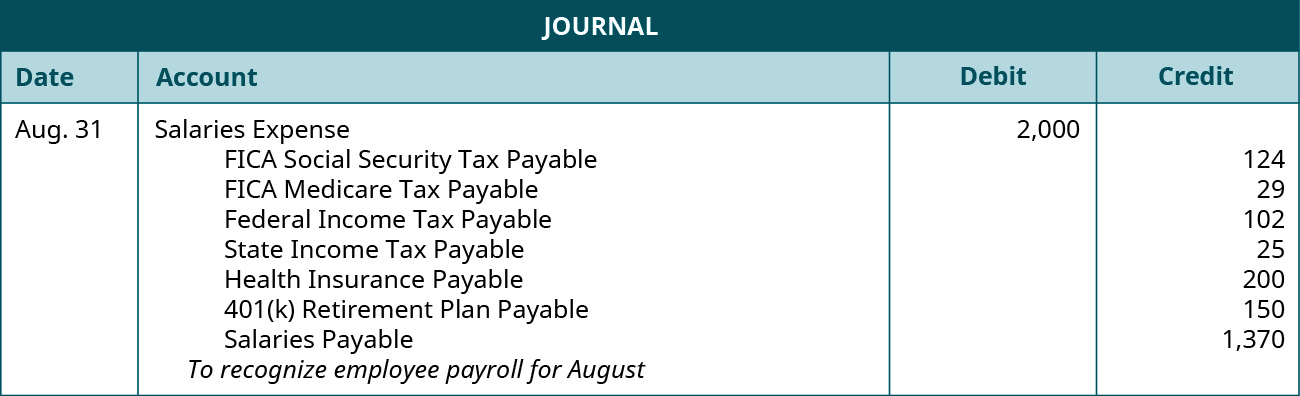

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says